Health insurance is a crucial component of personal and family well-being, offering financial protection against unexpected medical expenses. For individuals aged 25-40, obtaining reliable health insurance is especially important due to the varied health needs that may emerge during this life stage. In Moldova, the health insurance landscape has significantly evolved, providing various options tailored to the needs of young adults and families. This article delves into the most reliable health insurance options for individuals aged 25-40 in Moldova, discussing their benefits, coverage, and how to select the best plan.

The Health Insurance Landscape in Moldova

Moldova features a mixed healthcare system with both public and private health insurance options. The public healthcare system, managed by the National Health Insurance Company (CNAM), offers basic coverage to all citizens. However, many individuals opt for private health insurance to access a broader range of services, shorter wait times, and higher-quality care.

Key Considerations for Choosing Health Insurance

When selecting health insurance, individuals aged 25-40 should consider several factors:

- Coverage Scope: Understanding the extent of medical services covered, including hospital stays, outpatient care, prescription medications, and preventive services is vital.

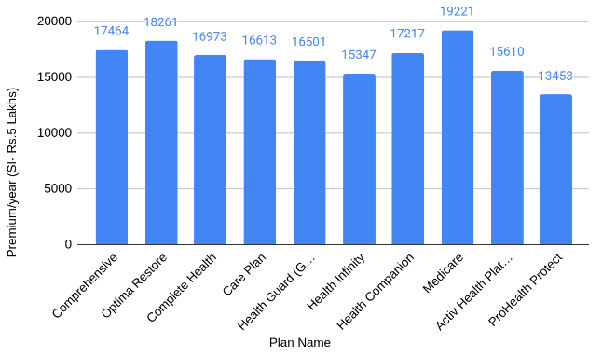

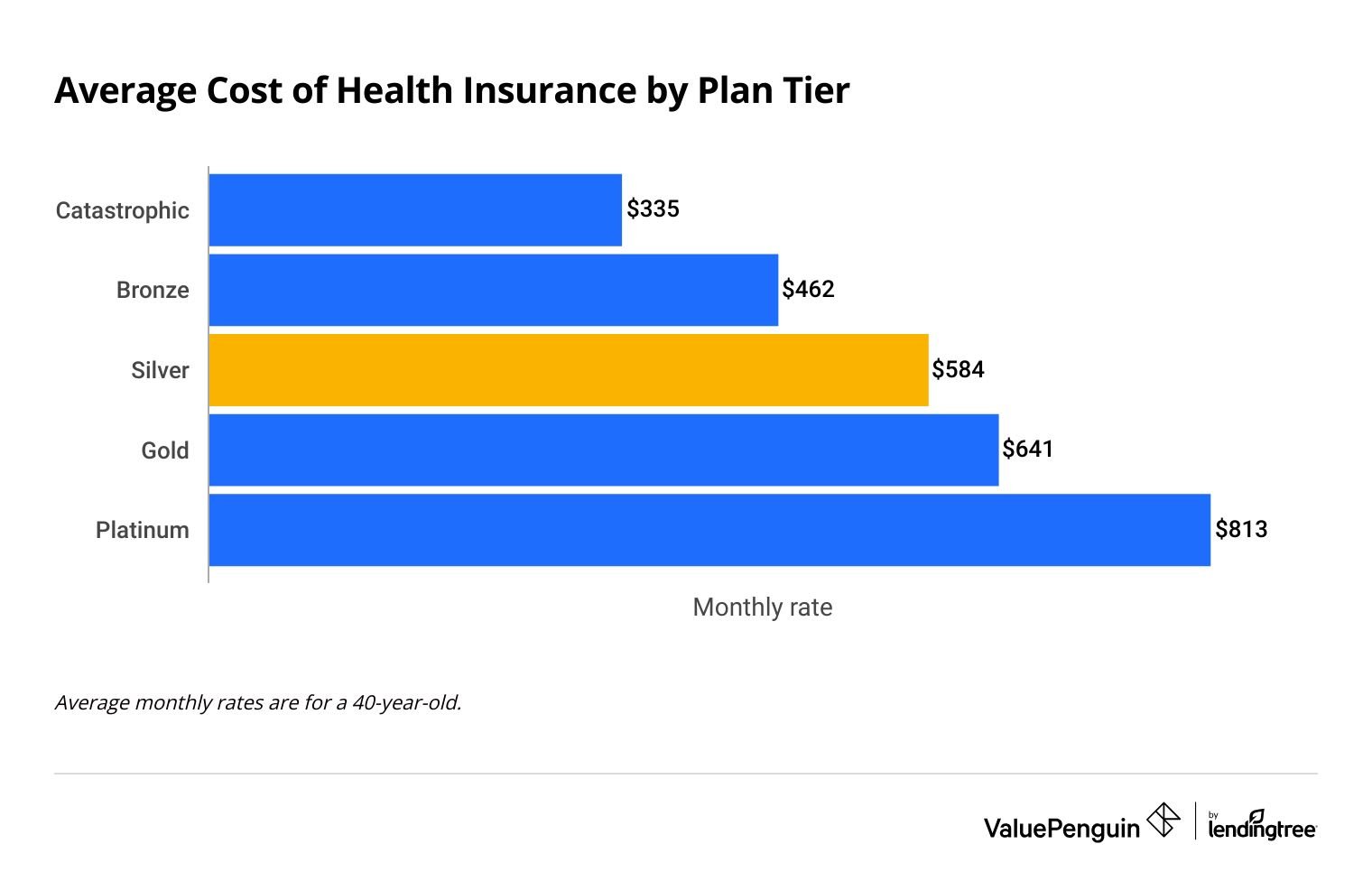

- Premium Costs: Monthly or yearly premiums can vary significantly. It’s essential to evaluate the cost relative to the benefits provided.

- Out-of-Pocket Costs: These include deductibles, co-payments, and co-insurance. Lower out-of-pocket costs can make healthcare more affordable.

- Network of Providers: Access to a broad network of doctors, specialists, and hospitals is an important consideration.

- Additional Benefits: Some plans offer extra benefits like dental, vision, and wellness programs.

- Customer Service: Reliable and accessible customer service can greatly enhance the user experience.

Public Health Insurance: National Health Insurance Company (CNAM)

The National Health Insurance Company (CNAM) provides mandatory health insurance for all Moldovan citizens. The CNAM offers a basic benefits package that includes:

- Primary Care: Coverage for visits to general practitioners and family doctors.

- Specialist Care: Referrals to specialists are covered, though there may be waiting periods.

- Hospitalization: Includes inpatient care for various medical conditions.

- Emergency Services: Emergency medical services are covered.

- Preventive Services: Includes vaccinations, screenings, and health check-ups.

While CNAM provides a safety net, many young adults and families seek additional coverage through private health insurance to supplement the services offered by the public system.

Private Health Insurance Options

Private health insurance in Moldova is offered by several insurers, providing various plans to suit different needs and budgets. Here are some of the most reliable private health insurance providers:

1. Medpark International Hospital Insurance Plans

Medpark is one of the leading private healthcare providers in Moldova. They offer comprehensive insurance plans that include:

- Extensive Coverage: Covers a wide range of medical services, including advanced diagnostics, specialist consultations, and surgical procedures.

- Network Access: Access to Medpark’s state-of-the-art facilities and medical professionals.

- Preventive Care: Includes regular health check-ups, screenings, and wellness programs.

- International Coverage: Some plans offer international coverage, which is beneficial for frequent travelers.

Medpark’s insurance plans are designed to provide high-quality care and convenience, making them a popular choice for young professionals and families.

2. Orange Moldova Health Insurance

Orange Moldova, primarily known as a telecommunications company, offers health insurance as part of its employee benefits. Their insurance plans are also available to the public and include:

- Comprehensive Medical Coverage: Covers a wide array of medical services, from routine check-ups to major surgeries.

- Affordable Premiums: Competitive pricing aimed at making quality healthcare accessible.

- Convenient Access: Partnerships with multiple healthcare providers ensure easy access to medical services.

Orange Moldova’s health insurance plans are designed to cater to the needs of a modern, mobile workforce, providing flexibility and comprehensive coverage.

3. Moldasig Health Insurance

Moldasig is one of the largest insurance companies in Moldova, offering a variety of health insurance plans that cater to different age groups and needs. Their plans feature:

- Customizable Options: Flexibility to choose coverage that suits individual needs, from basic plans to comprehensive packages.

- Wide Network: Access to a vast network of medical providers across Moldova.

- Additional Benefits: Options to add dental and vision coverage, as well as wellness programs.

Moldasig’s reputation for reliability and extensive coverage options makes it a trusted choice among Moldovans.

Comparing Health Insurance Plans

To determine the most reliable health insurance plan for individuals aged 25-40 in Moldova, a comparison of the major providers can be insightful. Here’s a comparative analysis based on key factors:

| Provider | Coverage Scope | Premium Costs | Out-of-Pocket Costs | Network of Providers | Additional Benefits | Customer Service |

|---|---|---|---|---|---|---|

| CNAM | Basic coverage | Low | Low | Nationwide | Limited | Public sector level |

| Medpark | Comprehensive, including advanced services | High | Moderate | Medpark facilities | Preventive care, international | High, personalized |

| Orange Moldova | Wide range | Moderate | Moderate | Multiple providers | Employee benefits, convenience | Good, with telecommunication support |

| Moldasig | Customizable options | Variable | Variable | Extensive network | Dental, vision, wellness | Reliable, extensive network |

Tips for Choosing the Right Health Insurance

- Assess Your Health Needs: Consider any pre-existing conditions, family health history, and lifestyle factors.

- Compare Plans: Look at the coverage, costs, and provider networks of multiple plans.

- Check Reviews: Research customer feedback and ratings for the insurance providers.

- Consult an Insurance Broker: They can provide professional advice tailored to your specific needs.

- Understand the Fine Print: Make sure you know what is and isn’t covered under the plan.

Conclusion

Selecting the most reliable health insurance for individuals aged 25-40 in Moldova involves a careful evaluation of various factors, including coverage, cost, and provider networks. Public insurance through CNAM offers a solid foundation, but many opt for private insurance to gain additional benefits and higher quality care. Medpark, Orange Moldova, and Moldasig stand out as top choices for private health insurance, each offering unique advantages. By thoroughly assessing personal health needs and comparing available plans, young adults and families can secure the best possible health insurance coverage to ensure their long-term health and financial security.